A New Marketplace for the Common Good

— by J. Greg Spencer & Gregory Spencer

Unrecognized Value

Most social impacts, even when quantified, remain significantly undervalued by investors and, at times, are completely unrecognized by the market. While impact investments and the emphasis on Socially Responsible Investing have increased significantly since 2000, the value of such investments are often either evaluated using traditional financial metrics or insufficiently considered in non-financial performance. Therefore, non-financial performance, or “positive externalities” remain external to the transaction.

We have evidence that this market failure exists from our own experience. After launching and operating several for-profit social ventures in East Africa over the last decade, we routinely sold the environmental benefits produced by our clean burning cookstoves into reasonably sophisticated carbon offset markets. However, we consistently received only a modest - if any - premium from also enabling families to save (and implicitly reinvest) more than twenty-two million dollars of income, thirty-one million hours of time, two and a half million trees, and arguably even more significant (but unquantified) improvements in health. We have also observed the inefficacy of development work and outdated models of donors and corporates paying for inputs hoping to achieve unverified impacts.

These unrecognized externalities mimic the conditions surrounding the emergence of the carbon markets in North America in the late 1990s. Working with large emitters who anticipated upcoming climate change regulations, we developed diverse sources and types of emission reduction projects to deliver newly created environmental assets. Ultimately, many of these project methodologies evolved into standards adopted by both commercial and regulatory bodies and became part of what is now a thriving industry.

A New Marketplace for Good

We believe the solution to capturing unrecognized social value is the development of a “Common Good Marketplace” – a place to value and exchange independently verified social impacts categorized within the UN’s 17 Sustainable Development Goals (SDGs). This Common Good Marketplace might well emerge following a development process similar to that in the carbon markets.

There are strong, but early indicators that this marketplace is already evolving. A handful of carbon registries, nonprofits, foundations, social enterprises and project developers are already creating new SDG-specific impact standards and methodologies with the goal of measuring social impacts. What we have not yet seen are any attempts to independently certify and then exchange these assets for value once created.

A marketplace will likely only grow when there is reasonably consistent supply and demand for the products and services provided. Therefore, the first step toward creation of such a market must be a much broader awareness that SDG impacts can be quantified for the purpose of being converted into assets. Once this awareness is combined with verifiable quantification methodologies, it seems only a modest step to then economically value and transfer them for the benefit of corporate buyers, foundations and donors, who could then better assess the “social ROI” of their investments.

The Relevance of Resiliency

The recent energy, airline and hospitality industry shocks, stock market volatility and higher long-term unemployment resulting from the COVID-19 pandemic demonstrates that corporate resiliency is more important than ever. “Resilience” can be difficult to monitor, quantify and develop, but through the lens of Environmental, Social and Governance (ESG) performance, it can more easily be identified and improved. According to Oxford University’s Robert Eccles, “Firms with a better ESG record than their peers produced higher three-year returns, were more likely to become high-quality stocks, were less likely to have large price declines, and were less likely to go bankrupt”. He was specifically citing the Bank of America Merrill Lynch ESG study completed in 2018.

We know that investing in environmental performance and the purchase of environmental assets increases performance of the environmental component of ESG. We believe a similar thesis exists for using social assets: companies will increasingly invest in internal, supply-chain, and external (third-party verified) social impacts to improve their ESG performance and long-term resiliency.

Limitless Opportunity?

In any market, suppliers, buyers, technical experts, capital, and infrastructure are needed. This Common Good Marketplace would serve non-profits, social enterprises, development organizations, foundations, and corporates. Impact measurement experts, auditors, economists and registries (certifiers of and repositories for impact) would make up the technical expertise required to quantify and qualify impact standards and methodologies; developers would create new business models that investors would finance; and, finally, foundations and corporates would create demand by purchasing quantified, verified outcomes, thereby demonstrably improving their ESG performance. The opportunities seem limitless. Could this new marketplace match the $215 billion in transaction value last year for the carbon markets, and attract investments as significant as Jeff Bezo’s recent $10 billion commitment to climate change (SDG 13)?

We know this market will require diverse expertise, actors and capital to work. We also know that faith like a mustard seed can move a mountain. Many of the faith-driven investors we have spoken to believe it is time for the faith community to demonstrate greater leadership in identifying and developing mechanisms and opportunities to enhance human flourishing.While we wait to see what roles are adopted by the faith community in this emerging impact marketplace, you may wish to consider how the organization's you manage or support might benefit from developing quantitative, verified "pay-for-performance" funding mechanisms for their social and environmental impacts.

This is one of the 2020 CEF Whitepapers. For more information on the Christian Economic Forum, please visit their website here.

Related articles

A crisis can reveal what we really value and should prioritize. It applies when we get seriously sick, when there is an upheaval in our family, or even during a pandemic. The sifting process may also show what really stands the test of time, and what is a mere short-lived trend.

The practical outworking of this one Brazilian entrepreneurial business family working together with a North American Christian ministry to create a culture of blessing, first in their own family and then in the community, is now resulting in a transformational prototype in which all 7 spheres of society are being positively impacted within the ecosystem of the city.

"The global Church must embrace economic development and job creation as an integral part of Christ’s prayer that God’s kingdom would come on earth as it is in heaven."

Ecosystem building requires time and patience. It is typically a co-creation process between local leadership and capacity and international expertise and resources.

In our experience, a healthy faith-based ecosystem is built on five pillars. The first two pillars are foundational and unique to our faith, while the others are also applicable in the wider secular context.

What distinguishes a faith-driven entrepreneur from a secular entrepreneur? What types of enterprises create what impact?

Faith-based enterprises transforming economies intuitively makes sense but its potential has yet to be realised. Why is this the case?

More than half of young people in Sub-Saharan Africa, who make up the largest part of the population, are born into poverty, growing up in communities that visibly offer no hope, with few if any ethical role-models and mentors.

It is my opinion that to have a more significant impact in the communities we serve, nonprofits must consider mergers and consolidation as a means of future survival.

Over the past 70 years there has been significant progress in raising living standards and quality of life around the world.

When the spirit of shalom permeates all that we do, victories come in the form of transformative moments.

We believe that Faith Driven Entrepreneurs and Investors can create transformation in four main ways; Wealth and Job Creation, Innovation, Evangelism, and Discipleship and Cultural Transformation.

Perpetuate Capital exists to perpetuate the Kingdom impacts of BaaMs, while solving for shareholder liquidity at market-based costs/returns with fully aligned investors.

What if faith-driven entrepreneurs, not just in the U.S. but worldwide, went all-in to commit their creative talents and abilities to advance God’s kingdom and be the agents of change for justice, equality and eradication of poverty?

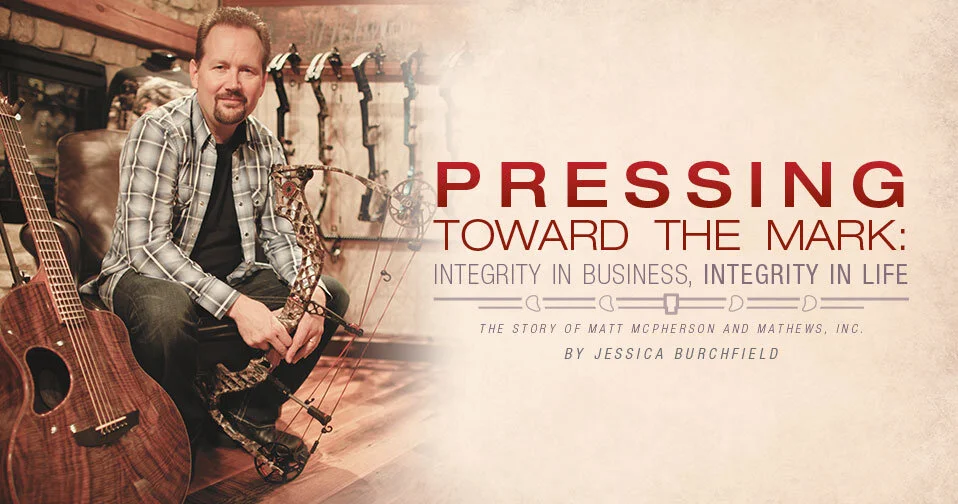

A modern day Christian Renaissance Man, Matt McPherson is the founder and CEO of both Mathews Inc., the largest bow manufacturer in the world, and McPherson Guitars, a leading name in the music industry for hand-crafted acoustic guitars

We’ve long preached sustainable development over handouts. The pandemic forces us to change our approach—for now.

Charity has a place, and relief efforts are needed. But for a long-term solution we need a paradigm shift in thinking and praxis, from handouts to job creation, from mainly non-profit responses to for profit solutions.

The effects of the coronavirus are disruptive beyond comprehension. The situation is changing by the hour. The consequences vary from difficult to dire for billions of people, and nobody knows what the timeline is for this crisis.

Applying biblical principles to shape best practices in business may sound challenging or scandalously illegal, but it’s surprisingly achievable and worthwhile. And while this view of stewardship may seem to be an ethereal, fluid concept, ministry can be objectively measured with worthy metrics of success much like any other dimension of thriving business.

In rural Mexico, fifty 3D printed homes are being built under the leadership of our most recent podcast guest, New Story CEO, Brett Hagler. The innovative project that’s the first of its kind is part of New Story’s larger goal of combatting global homelessness. This 3D printed neighborhood is set to house local families living on less than $3 a day.

Mats Tunehag came back from the Freedom Business Forum inspired by Annie Dieselberg’s speech: she shares her journey in realizing that the creation of business is a key to sustaining freedom because it provides us with life-giving choices. Freedom businesses are about restoring the power to choose, redeeming the value of life, and making money for good impact. Freedom businesses give people the chance to dream again!

The remarkable story of one gutsy contractor’s determination to end poverty in Africa. Grant Smith is not a visionary or an enthusiastic missionary. He’s a problem solver. When confronted with the desperate problems of poverty he witnessed in Africa, he did the only thing he knew how to do–business.

HAPPY MONDAY! We wanted to start the week with an encouraging video from a reader just like you. Jon Porter shares a video story of a dairy processing business that God called him to start in Rwanda employing the deaf. As he puts it, “It was an exciting, overwhelming, full-of-miracles experience …” and from what we can see, we couldn’t agree more!

“Kingdom success along the path of risk and failure.” - For many entrepreneurs, the possibility of startup glory — a huge payout, an early retirement, fame, acclaim, and the chance to transform how societies function — is worth the risk and the toil. And what if those momentous outcomes never come to fruition?

Mats Tunehag shares stories from around the world. In this piece, he reminds the reader that we cannot convert anyone by pushing through or forcing a spiritual impact. This is essential as we do business as mission.

This article was from a collection of whitepapers compiled for attendees of the CEF’s 2018 Global Event. We share Darin’s whitepaper in anticipation of 2019 CEF whitepapers launching soon! Read Darin Owen’s view on how to start, build, and grow prosperous companies.

Mats Tunehag’s stories from around the world are now in book form! BAM Global Movement: Business as Mission Concepts & Stories is a unique blend of short chapters explaining the ‘business as missions’ concept interspersed with brief case studies of BAM businesses.

What areas of your life do you long to see reconciled and made new? By asking the deeper questions, The Chalmers Center helps people wrestle with problems with work as a whole. Their training courses are there to help with restoring work to its a place of glorifying God and helping others.

The Church is beginning to combat extreme poverty in a more complete way. This is a movement where discipleship, job creation, training, and financial services are building on local relationships to empower communities to break free from poverty.

We are in the process of a tectonic transformation in the way we work and live – let’s rise to the challenge of using generative AI to speak and create life, rather than standing on the sidelines.